Application for Employment Authorization (I-765)

B-1

B-1 Temporary Business Visitor

B-2 Tourist Visa

Blogs

Business Development

Business Formation

Business Transactions

Business Transactions Blog

Change of status applications, including F-1, H-4, L-2, etc.

Concurrent Filing

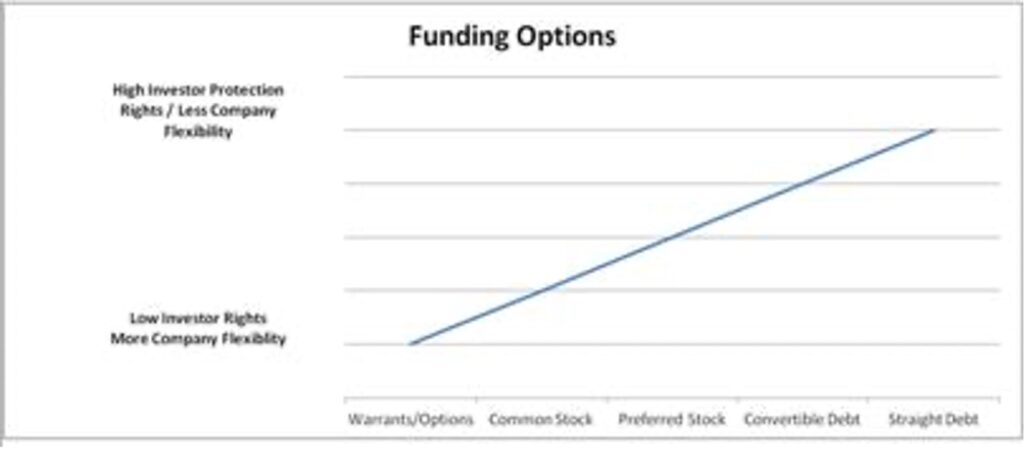

Corporate & Securities

COVID-19 Assistance

Cryptocurrency

Deferred Action for Childhood Arrivals (“DACA”)

Divorce

E-2 Treaty Visas

E-2 Visa

E-3 Specialty Occupation Professionals from Australia

E-3 Visa General Information

EB-1, EB-2, National Interest Waivers, and EB-3

EB-5 Information

Emergency Assistance

Employment-Based Immigration

Extreme Hardship Waivers

F-1 International students- CPT/OPT and STEM OPT

Family Based Immigration

Fiancé Visa (I-129F)

Fidelity National Title

Form I-9

Green Card Through Marriage

H-1B Information

H-1B Specialty Occupation & H-4 Dependent visas

H-2B Visa

Immigration Blog

Immigration Compliance

Immigration FAQ Videos

Investor Green Cards

L-1 Intracompany Transfer Visas & L-2 Dependent Visas

Naturalization

News

O-1 Individuals with Extraordinary Ability or Achievement

Parent/Sibling Petitions

PERM Labor certification/I-140/I-485 Processing

PERM/I-140/I-485 Information

Private Placement Memorandum (PPM)

Real Estate Transactions

Regional Center Formations

Removal Of Conditions (Form I-751)

Source Of Funds

Subscription Agreements

TN visas for Canadian and Mexican Professional Workers

Transactional FAQ Videos

Uncategorized

USCIS Requests for Evidence (RFE responses)

USCIS Requests for Further Evidence General Information

Videos

Violence Against Women Act (VAWA)

Visitor Visa